In a recent unsettling development, American Express has confirmed that sensitive information related to its credit cards has been compromised due to a data breach at a third-party service provider. This incident has raised serious concerns about the security of financial data and the implications for customers worldwide.

The Breach Explained

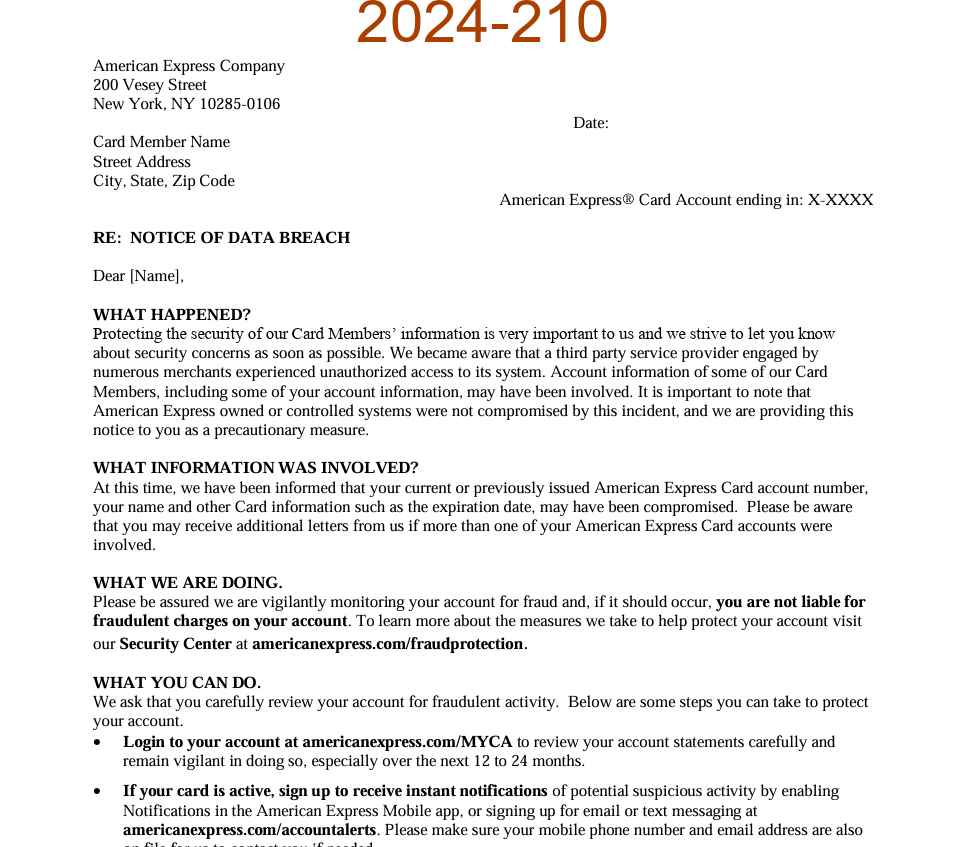

The breach was reportedly executed by a third-party merchant processor, which inadvertently allowed the sensitive information of American Express cardholders to leak onto the dark web. This exposed data includes American Express Card account numbers, expiration dates, and possibly other personal information, putting customers at risk of fraud and identity theft.

American Express has been proactive in addressing the situation, notifying affected customers and urging them to remain vigilant for signs of unauthorized activity on their accounts. Despite the breach, American Express has emphasized that its own systems were not compromised, pointing to the external nature of the security lapse.

Impact on Customers

The exposure of credit card details in a third-party data breach is a stark reminder of the vulnerabilities that exist within the digital financial ecosystem. For customers, this incident underscores the importance of monitoring their financial statements regularly and reporting any suspicious transactions immediately.

American Express has assured its customers that it is taking the necessary steps to mitigate the impact of the breach. This includes offering free credit monitoring services to affected individuals to help protect their financial information from further misuse.

Industry-Wide Concerns

This incident is not isolated, as data breaches involving third-party service providers have become increasingly common. The reliance on external vendors for processing financial transactions and handling sensitive data introduces additional risks that companies must manage. It highlights the need for stringent security measures and continuous vigilance to protect against cyber threats.

Moving Forward

In response to the breach, American Express and other financial institutions are likely to reassess their relationships with third-party vendors and enhance their security protocols to prevent similar incidents in the future. This may involve more rigorous vetting processes, the implementation of advanced cybersecurity technologies, and closer collaboration between companies and their service providers to ensure the highest standards of data protection.

For customers, the breach serves as a critical reminder of the need to be proactive in safeguarding their personal and financial information. This includes using strong, unique passwords for online accounts, enabling two-factor authentication where available, and being cautious of phishing attempts and other online scams.

The exposure of American Express credit card details in a third-party data breach is a concerning event that highlights the ongoing challenges in securing financial data. As the digital landscape evolves, so too do the tactics of cybercriminals, making it imperative for both companies and consumers to remain vigilant and proactive in their cybersecurity efforts. American Express’s commitment to addressing the breach and supporting its customers is a positive step, but it also serves as a call to action for the industry to strengthen its defenses against future threats.

Update from American Express

The incidents that you are inquiring about occurred at a merchant or merchant processor and were not an attack on American Express or an American Express service provider, as some media outlets have erroneously reported. Because customer data was impacted, American Express provided notice of the incidents to Massachusetts agencies and impacted customers who reside in Massachusetts.

American Express Card Members are not liable for fraudulent charges on their accounts. We have sophisticated monitoring systems and internal safeguards in place to help detect fraudulent and suspicious activity. If we see there is unusual activity that may be fraud, we will take protective actions. We also recommend customers regularly review and monitor their account activity, and immediately contact us if they detect any suspicious activity. For added protection, customers can receive free fraud and account activity alerts via email, SMS text messaging, and/or notifications through our app.

This blog post on the Massachusetts state website may shed a little more light on the different circumstances under which financial institutions may report incidents. For example, a financial institution may report an incident that occurred at a retailer where the consumer used their bank-issued card.

Information security specialist, currently working as risk infrastructure specialist & investigator.

15 years of experience in risk and control process, security audit support, business continuity design and support, workgroup management and information security standards.